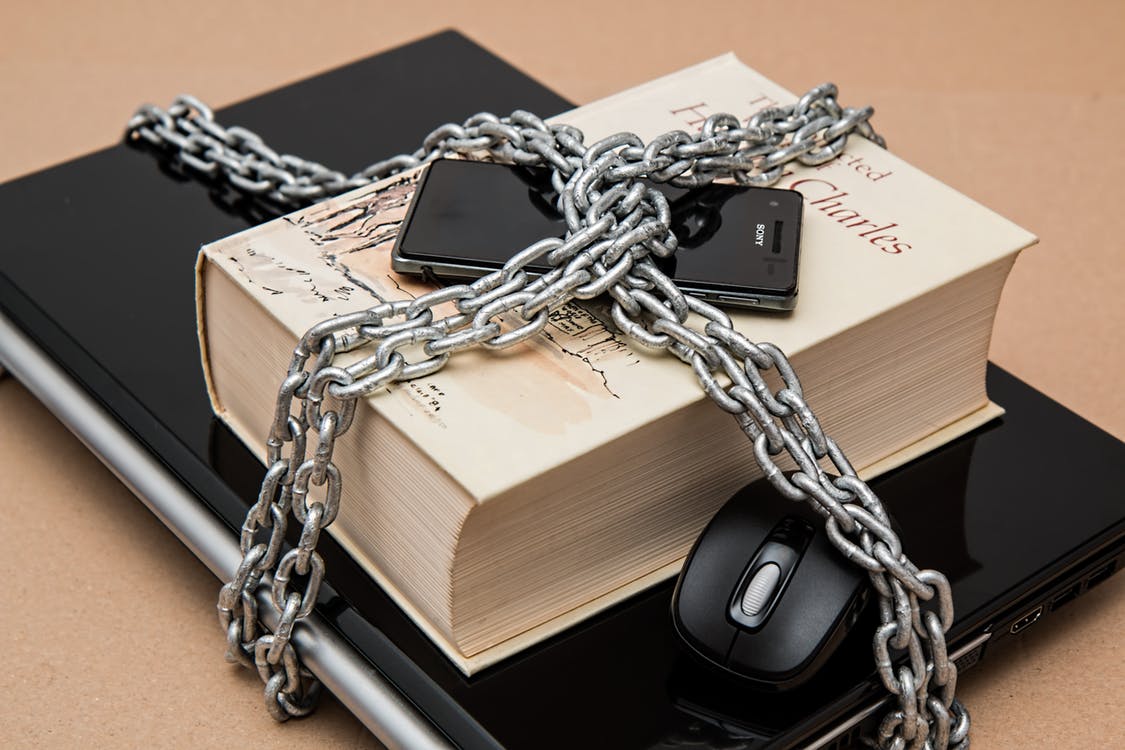

March 3 through March 9, 2019 is National Consumer Protection Week. Here are a few things that you can do to make your information more secure.

- Create a strong and unique password for every account.

Remembering passwords for every online account seems impossible… that’s why we use the same password for all of our accounts, right? It is easier but it’s definitely not safe. If a criminal obtains your password for one account, it’s likely they can gain access to almost every other account when you practice the one-password method. Utilize a password manager to help you manage all of the strong passwords.

- Make sure your online banking contact information is up to date.

Security notifications are completely useless if you aren’t receiving them. Annually, you should ensure that the organizations with which you have online accounts have your correct and up-to-date contact information. And when you get a notification, respond (meaning look it the issue… don’t ignore it) to it immediately, even if it seems benign.

- Enable two-factor authentication for account log ins.

Two-factor authentication is a relatively new form of account protection. The way it works is when you log in to an account, such as your online bank account, you will receive an access code, usually in the form of a text, to verify your identity. On accounts that have a lot of your information, such as your email and bank accounts, go into your settings and enable two-factor authentication.

- Review your credit report often.

Although we have been teaching consumers that only a few forms of identity theft can be tracked through your credit reports, we do think it’s essential not to neglect your credit report. Most credit card companies offer your credit report for free, so utilize that service to be aware of your credit history.

- Download only trusted apps.

There are some 2,000,000 apps on Apple Store and 2,100,000 in the Google Play Store. Unfortunately, there has been no regulation when it comes to putting an app on one of these stores as these “stores” are hosted by private companies. That means some of the apps are designed with malicious intentions wherein they might be gathering data on you without your permission like bank account login information.

Although you cannot ensure that a company with which you do business will not have a data breach, it is important to take steps to secure the information that you do put out there.

The bottom line is that there’s really no better time than the present to become a LibertyID member for identity theft restoration protection. LibertyID provides expert, full service, fully managed identity theft restoration to individuals, couples, extended families* and businesses. LibertyID has a 100% success rate in resolving all forms of identity fraud on behalf of our subscribers.

*Extended families – primary individual, their spouse/partner, both sets of parents (including those that have been deceased for up to a year), and all children under the age of 25