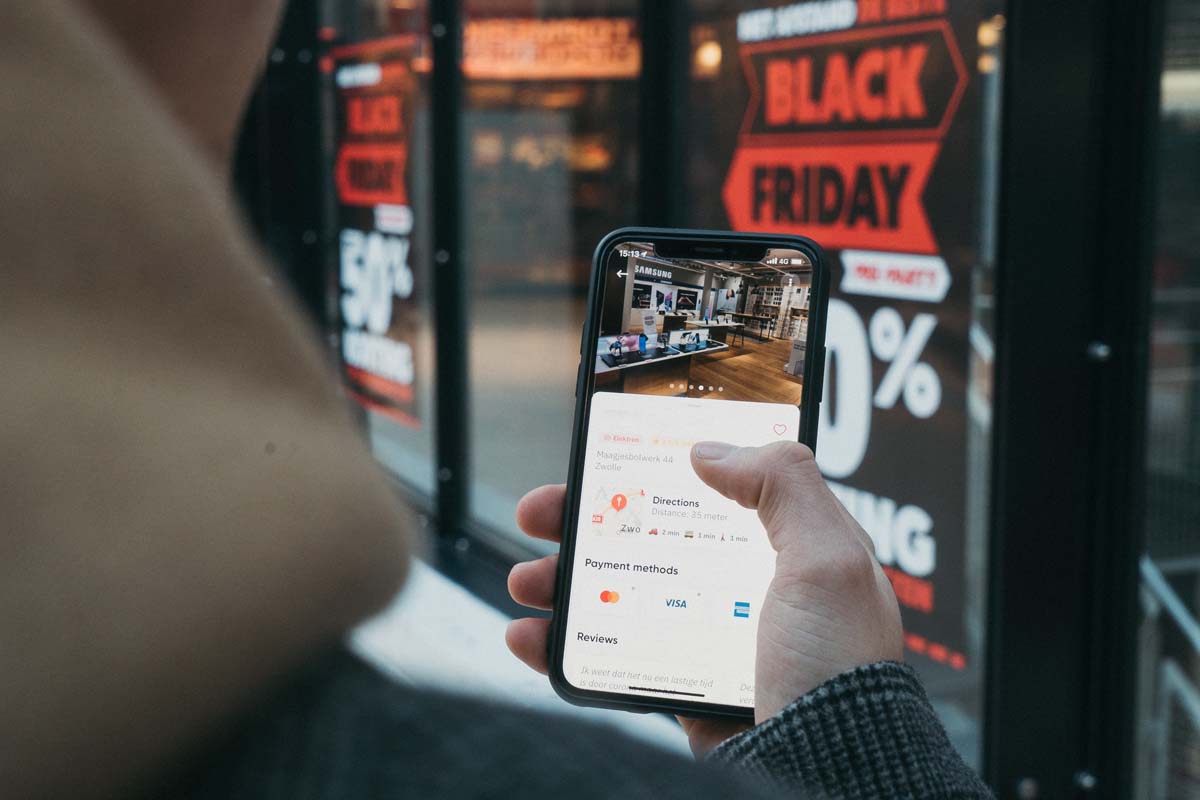

The holiday shopping season is here in full force, and with that comes savings alongside security issues. No matter what products you seek and regardless of who is on the gift list, online shopping presents many risks to the average consumer. That doesn’t mean you should limit your cyber spending, but it does require awareness and effort to spot potential scams and tactics that criminals use this time of year. With that in mind, let’s dive into some tips for safer shopping for this Black Friday and beyond.

The Numbers

Online spending has skyrocketed in recent years. This is partly caused by reduced in-person shopping opportunities brought on by the pandemic and reflects a consistent trend in consumer habits. 2020 was a banner year for ecommerce retailers as nearly $800 billion was spent online, marking an increase of over 30% from the previous year.

2021 should meet or exceed that total, meaning that more money is being spent online than ever before, with much of it coming during the holiday season. This indicates that business is good for retailers with ecommerce outlets, and consumers have plenty of options to take advantage of. It also highlights the enormous financial incentive that exists for cybercriminals looking to prey on the public at every opportunity.

The Threats

Online shopping has its risks at any time of the year, and this is not exclusively a seasonal issue. What is seasonal is an increased effort by threat actors to scam shoppers any way that they can. The threats highlighted in this post might be more common surrounding the Black Friday shopping season, but they are always possible. Keep that in mind, and make sure that you practice safe spending habits year-round.

Fake Website Scam – This scam involves tricking consumers into purchasing products from a website that isn’t real. Victims of this scam can have their personal information or money stolen, often both. Criminals set up an authentic-looking website that mimics a well-known or established retail website. They may also lure consumers to the site by offering fake coupons via email or social media.

- How to limit risk: Always make sure that a website is authentic before attempting to make a purchase or providing personal information. If you are emailed a coupon or find a deal that appears too good to be true, it’s most likely phony. Double-check the deal or website by visiting the legitimate retailer’s website to see if that same deal can be verified.

Holiday Delivery Phishing Scam – This scam comes in the form of an email or text message saying that there is a delivery issue with something you have ordered – when you haven’t actually ordered it. Unsuspecting consumers can be tricked into providing financial or personal information thinking this will get the issue with their bogus item figured out. If you have made multiple purchases, this scam can be easy to fall for.

- How to limit risk: Never click on a link in a random email saying there is an issue with a delivery. Keep track of all your legitimate order numbers to cross-reference if any issues arise. Always be suspicious of messages informing you of delivery issues, especially during the holiday season. Contact the retailer or shipping company directly if information on delivery status is needed.

Gift Card Scam – This one commonly occurs when shopping through popular auction sites like eBay. If a seller asks that you need to pay with a gift card for an item, it’s more than likely a scam. Gift cards present an easy opportunity for criminals to steal your money, and you should never be required to make a purchase using one.

- How to limit risk: Use a credit card when paying for products online, as most credit card issuers provide zero liability for fraudulent purchases. Recognize the red flag if asked to pay for a purchase using a gift card and, if so, be sure to end the online buying transaction immediately.

Digital Credit Card Skimming: This is more of a tactic used to steal credit card information than a scam, but it’s still another holiday shopping threat to be aware of. Hackers can sneak malware and other code within a retailer’s official website that will skim consumer credit card information, placing it directly in the hands of criminals.

- How to limit risk: This issue is difficult to spot because it often involves a data breach within the retailer itself. To limit the potential theft of your credit card information, never save this data on retail websites and use a third-party payment method if possible. You should also enable purchase alerts on all cards to warn you if stolen information is being used fraudulently.

The Steps to Take for Safer Shopping

The scams mentioned above reflect only some of the most common ways that cybercriminals attempt to profit from holiday spending. Keep these steps and tips in mind for safer spending before, during, and after you make any online purchases.

- Check to ensure that any electronic device used for online shopping is up to date with current software. This applies to smartphones, tablets, computers, and any other internet-connected device. It will add another layer of security to keep up with evolving threats.

- Only shop through trusted sources that can be verified. Make sure that you are on a legitimate retail website before providing any information. Be leery of suspicious coupons or deals that seem too good to be true.

- Don’t click on any suspicious links or attachments from supposed retailers that you may receive through email or text messages. Never give out your personal information in response to an unsolicited email.

- Always use safe methods of payment to limit the potential for fraud. Using a credit card rather than a debit card will limit your liability if unauthorized charges occur. Keep an eye on all bank accounts for any suspicious activity.

- Have an identity theft restoration plan in place ahead of time to further limit your risk of fraud and to have valuable support if you do fall victim.

- Look at some more holiday shopping tips from the Cybersecurity & Infrastructure Security Agency here.

LibertyID provides expert, full service, fully managed identity theft restoration to individuals, couples, extended families* and businesses. LibertyID has a 100% success rate in resolving all forms of identity fraud on behalf of our subscribers.

*LibertyID defines an extended family as: you, your spouse/partner, your parents and parents-in-law, and your children under the age of 25.